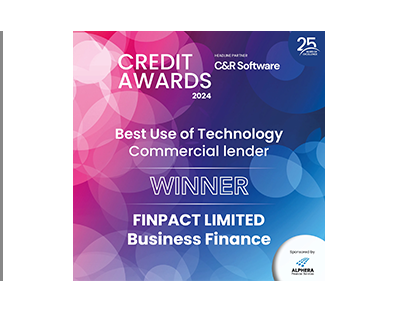

WHO WE ARE

FINPACT is a US-based fintech company focusing on the auto

finance sector. It is committed to reshaping traditional

models through innovative technology and driving the

industry's digital and intelligent upgrade.

The company completed its early international expansion by

registering in the British Virgin Islands (BVI) in October

2023. After obtaining its US business license in December

2025, it officially began operating and adhering to compliance

as its core entity in the US, fully advancing its

internationalization strategy.

Leveraging its self-developed digital platform and deeply

integrating big data, AI, and blockchain technologies, FINPACT

builds an intelligent, secure, and reliable auto finance

service system, providing efficient, transparent, and

trustworthy solutions to the global market.

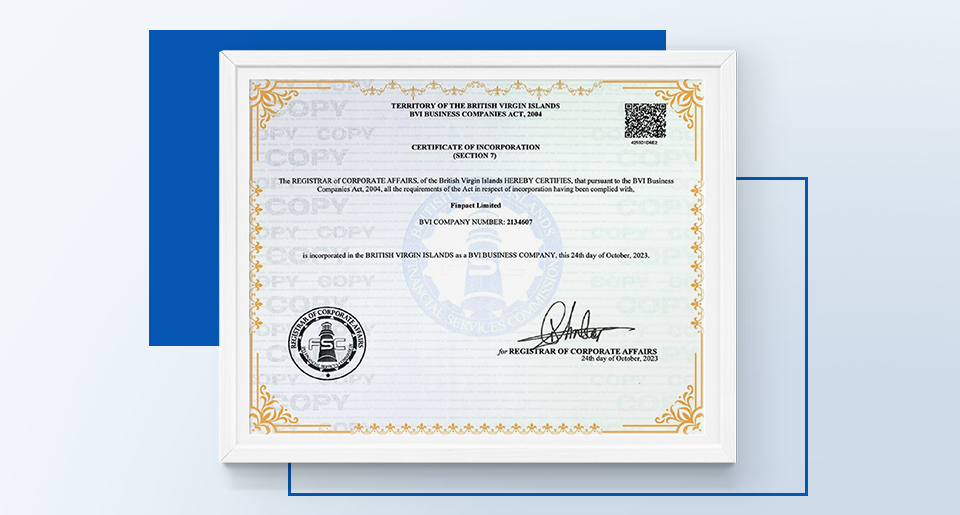

Multiple compliance systems

Currently, Finpact holds a BVI business license (for an

international company), a New York business license (for legal

local operation), a US MSB financial license (for financial

regulatory compliance), and an LEI international legal entity

identification number (98450054WA0CBA0A4553).

This multinational compliance system is completely legal and

transparent, representing the most standard and secure

architecture for global multinational corporations, ensuring that

the rights and interests of all users are protected under

international regulation.

Why choose FINPACT LIMITED

Its professional financial team is composed of elites with profound academic backgrounds and rich experience in world-renowned financial institutions. They have a precise understanding and judgment of the financial market.

The diversified auto finance products launched cover the entire automotive industry chain, from personalized solutions for car purchase financing, to various flexible forms of leasing financing, to efficient funding solutions provided by supply chain finance for upstream and downstream enterprises, all of which reflect its deep insight into market demand and innovative capabilities.

Choosing FINPACT LIMITED means choosing a company that excels in professional financial capabilities, business innovation, and market layout, laying a solid foundation for its development and success in the field of auto financial services.

Our Team

GUO Jiaming

Michael Jardine

Kevin Phillips

Duncan Beatty

Chris Walker

Company Development History

Strategic launch: Insight into the trend of auto

finance reform, establish an auto finance division,

and anchor the track

Team building: Start recruiting global elites and

build a "finance + industry + technology" composite

team

Market research: Use data modeling and field research

to lock in the two major tracks of used car finance

and new energy installment

Resource layout: Establish cooperation intentions with

6 leading auto companies, access third-party

evaluation agencies, and build a business ecosystem

Entity registration: Complete registration in the

British Virgin Islands and build a global legal

framework

Architecture upgrade: Adopt matrix management,

formulate standardized operation manuals, and ensure

efficient operation

Technology research and development: Cooperate with

AWS to develop a microservice platform and conduct key

technology verification such as smart contracts

Ecological cooperation: Participate in industry

summits, introduce OpenAI technology, and explore

blockchain application scenarios

Cross-border business breakthrough: the first

cross-border new energy financing lease was

implemented (European car companies × Southeast Asian

shared travel), blockchain technology shortened the

cycle by 40%, and the bad debt rate was 0.3%

Capital and strategic layout: completed US$8 million

in financing, and the funds were used for technology

research and development (40%), talent development

(30%), and market expansion (30%). The headquarters

moved to New York and connected with international

financial institutions to establish cross-border

capital channels

Regional business expansion: Asia: second-hand car

mortgage financing, car dealer capital pool services,

Middle East: water-soaked car recycling and

processing, refurbished export + parts

remanufacturing, Europe: new energy supply chain order

financing, accounts receivable coordination

Compliance system construction: obtained the US MSB

license, deployed AI anti-money laundering system and

blockchain KYC. The global intelligent compliance

platform is connected to multiple regulatory

interfaces in real time